01 Sep Bias in boardroom decision-making

People aren’t good decision-makers. We all know that. And sadly, it’s not just a problem for others: it’s part of the human condition. We never have all the information that we need, we can’t process all the information we have, and we aren’t good at rationalising that information to make an optimal decision. What’s more, subtle – and often hidden and unhelpful – influences are at work. Nonetheless, decisions still have to be made. But boards and directors, who regularly having to make calls which have big consequences, are rarely conscious of the natural biases at work.

So, how do we deal with these limitations in our mental processes? Part of making good decisions is to be aware of natural tendencies that affect us all so that we can guard against them. It’s an enormous topic with no easy answers, but below we set out just a few things for you to think about – and touch (very lightly) on a few bits of decision-making theory that might just be useful to bear in mind.

Good practices to consider…

Be prepared to be the bad guy. Yes, the NEDs should be ready to support the management. But sometimes it can be their job to pop the balloon at the party. When personally invested in a scheme, the desire for it to succeed can overwhelm even the most rational mind. So, one of the ways NEDs must support management is by protecting them from excess enthusiasm, which means remaining detached enough to provide a level head.

Things to avoid…

Tending to over-optimism is a natural phenomenon and often exacerbated by the enthusiasm of those around you. The executives will come to the Board very energised about their latest scheme – and, particularly where the Board has been dipped into the scheme as it developed, NEDs can be swept up by the mood and the optimism of those around them. It can be difficult to give due weight to flaws in a plan when you are all emotionally committed to it succeeding. While it can be very helpful for the Board to get involved in major plans at an early stage, it is also essential that the NEDs keep an emotional distance.

Good practices to consider…

Understand why that particular plan was chosen versus others – and versus “no change”. Even if they are not given alternatives to decide between, it is useful for the Board to see the alternatives that were considered and rejected by the executive. Showing the consideration given to these alternatives gives confidence in the option chosen. But it can also have the effect of making the chosen option look better than it is, simply because it is better than the alternatives – so it is important to evaluate a plan, not only against the alternatives provided, but against the status quo, doing nothing, or the need to spend more time considering other options which have not yet been looked at.

Things to avoid…

Letting the alternatives dictate the decision. The way in which alternatives are presented can determine the option chosen, and that this can be manipulated, either unconsciously or deliberately. As a simple – but not unrealistic – example, a board may choose to maintain the full marketing budget because the alternative presented is to slash it in half. The optimal may be a 15% reduction, but presented with only the two options, the choice seems clear.

Good practices to consider…

Think through the most important factors that should influence the outcome, and make sure that the data and information provided directly answers the question. Boards often have to make decisions on complex questions where many different factors could determine the outcome – so they need to judge how far they have a picture of what matters.

Things to avoid…

Concentrating on the question that is easiest to answer – the one with readily available data and obvious KPIs to forecast. Instead, in preparation for making a big decision, think about the awkward questions you need to ask yourselves (or ask the executive) to get as close as you can to answering the complex, over-arching question. Bounded rationality is the idea that we are all limited in decision-making by the complexity of the question, our own mental capabilities, and the time available. Boards suffer these just as much as people do, if not more.

Good practices to consider…

Look out for where you’re using a rule of thumb or a mental shortcut used to reach an answer. We all do it, and the more experienced we are, the more opportunity we have had to form them. But they aren’t always right for the actual circumstances so they need to be challenged and sense-tested.

Things to avoid…

Simplifying and overlooking information that more reflective consideration could find useful. Heuristics (the posh name for rules of thumb) evolved as mental shortcuts to help us reach a quick answer. For example, if I asked you whether your company has a good culture, you might tell me “yes” because the CEO seems cheerful, fellow board members respect you, and you have a strong brand. But you might miss a major risk such as a lack of transparency in one of your business divisions. Heuristics have led you to the wrong underlying questions and therefore to miss something important.

Good practices to consider…

Judge the plan, not the presenter. Yes, the capabilities of those responsible for delivery is important, but it is easy to prejudge an idea based on the trust or mistrust placed in the sponsor behind it. It should not matter who is presenting a plan, how well you regard them, what they have achieved before, or how well they present. So, make an explicit acknowledgement, to yourself at least, of your attitude to the sponsor, as the basis for checking that trust in the person does not replace confidence in the plan. And try imagining the plan being presented by someone you don’t rate, and see if you still think the evidence stacks up.

Things to avoid…

Allowing sunflower bias to confer the regard in which you hold the person pitching the concept to the concept itself. Good people can have bad ideas, and one of the key responsibilities of NEDs is to help identify these.

Good practices to consider…

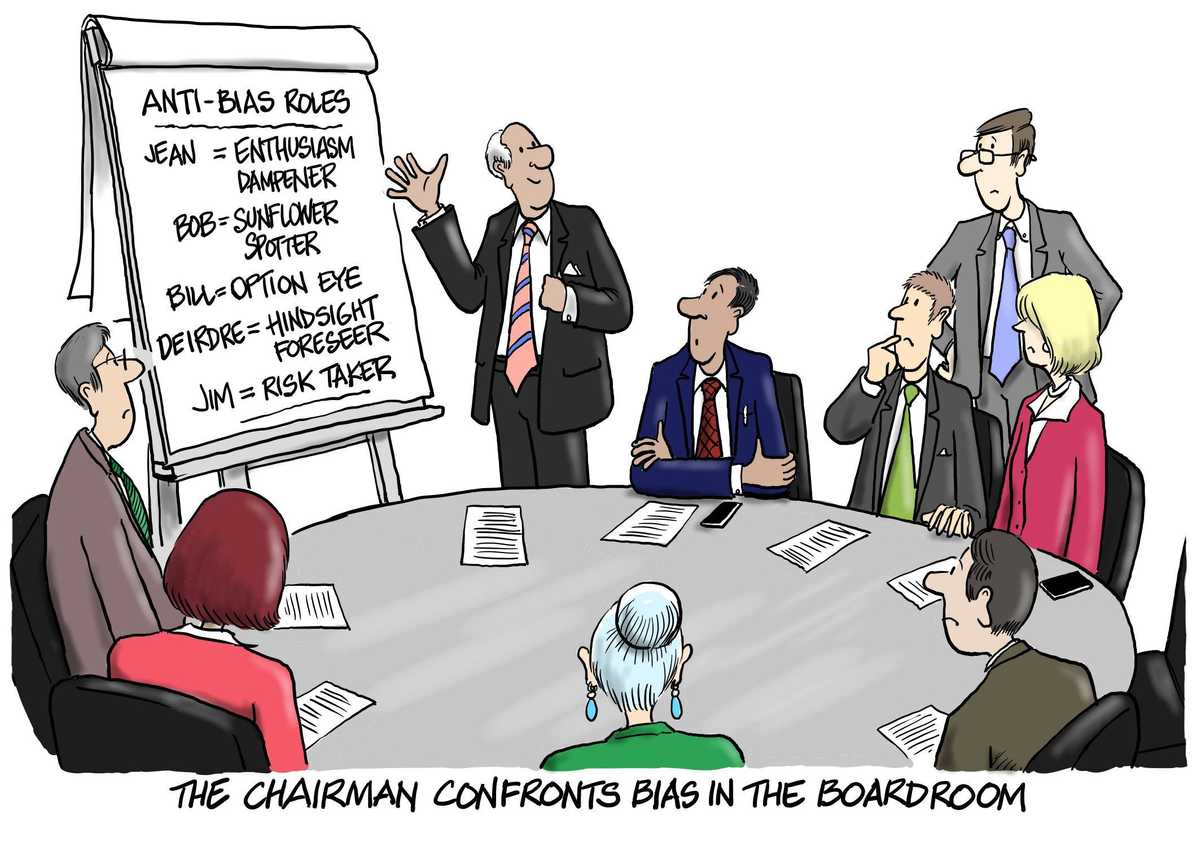

Give people space to make up their own minds without their views being anchored to those of others. The Chairman has a key role to play in reducing bias in discussions: if a strong view is aired early in the conversation, particularly by a strong-minded or outspoken voice, they should seek a contrary view to get balance before others are too strongly swayed.

Things to avoid…

The Chairman (Board or Committee) being the first to offer their views. This should normally be avoided – no matter how well-informed they are. An extension of sunflower bias is brought out in boards where the Chairman speaks first. Particularly if they air a strong view, they influence the direction of the discussion. It isn’t just a matter of others having the courage to disagree, although of course that comes into it. With the respect that comes with being Chairman, sunflower bias can kick in again here – and happen unconsciously especially where it’s reinforced by an inherent social pressure towards conformity.

Good practices to consider…

When looking for evidence for or against a decision, look at the questions that have been asked and the sources of the response, and question whether there is scope for bias to have occurred. It can be difficult not to see what you want to see. If in doubt, see if you can reframe the question so that it turns the decision against your instinctive judgement. If you can, perhaps your questioning isn’t as balanced as it could be. And for the more important matters, designate one or two NEDs to play Devil’s Advocate to test the robustness.

Things to avoid…

Putting extra weight on those things that support your hypothesis and deafening yourself to things that don’t – that’s confirmation bias. For examples, see the Brexit debate, passim… So, in boardroom debate it’s as important to explore what’s not there as what is. Did the analysis set out to find evidence to support a hypothesis? Or was it done in such a way that negative evidence could be surfaced and given proper weight?

Good practices to consider…

Be conscious of our natural inclination to avoid the risk of loss. Remember that doing nothing, even if it feels like playing safe, has its own consequences. It is a risk-taking decision which has to be considered as rigorously as any other, not accepted passively.

Things to avoid…

Allowing loss aversion to stop you taking risks, even where it would be sensible to do so. The classic theoretical example is when I offer you a coin toss – heads, I give you £2,000, tails, you give me just £1,000. Statistical logic says it’s a risk worth taking, emotion says it isn’t because the pain of losing would be felt more than the pleasure of winning. A common practical example is persevering with a less-than-satisfactory executive for fear that change could cause disruption, where actually the gains of change far outweigh the risks.

Good practices to consider…

When thinking through the risks, consider what might have been missed by the models, which often assume “normal” volatility. Have you given due weight to “tail risk” – an extreme negative outcome? Which of our supposed facts are actually assumptions that could prove to be wrong? What if two bad things happen at once? And the very valuable question unhelpfully disguised by calling it “reverse stress testing”: what would have to go wrong to make us fail?

Things to avoid…

Assuming all swans are white. A black swan event is one that is presumed not to be possible simply because no one has seen it happen before. A topical example, in view of the recent tenth anniversary of the run on Northern Rock, is the complete drying up of the interbank money markets. Until that happened, liquidity risk was seen only in terms of an individual bank’s ability to access the markets. The continued availability of the markets was taken for granted – but it was a presumption, not a fact.

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.