01 May Remuneration Committees again on the front line

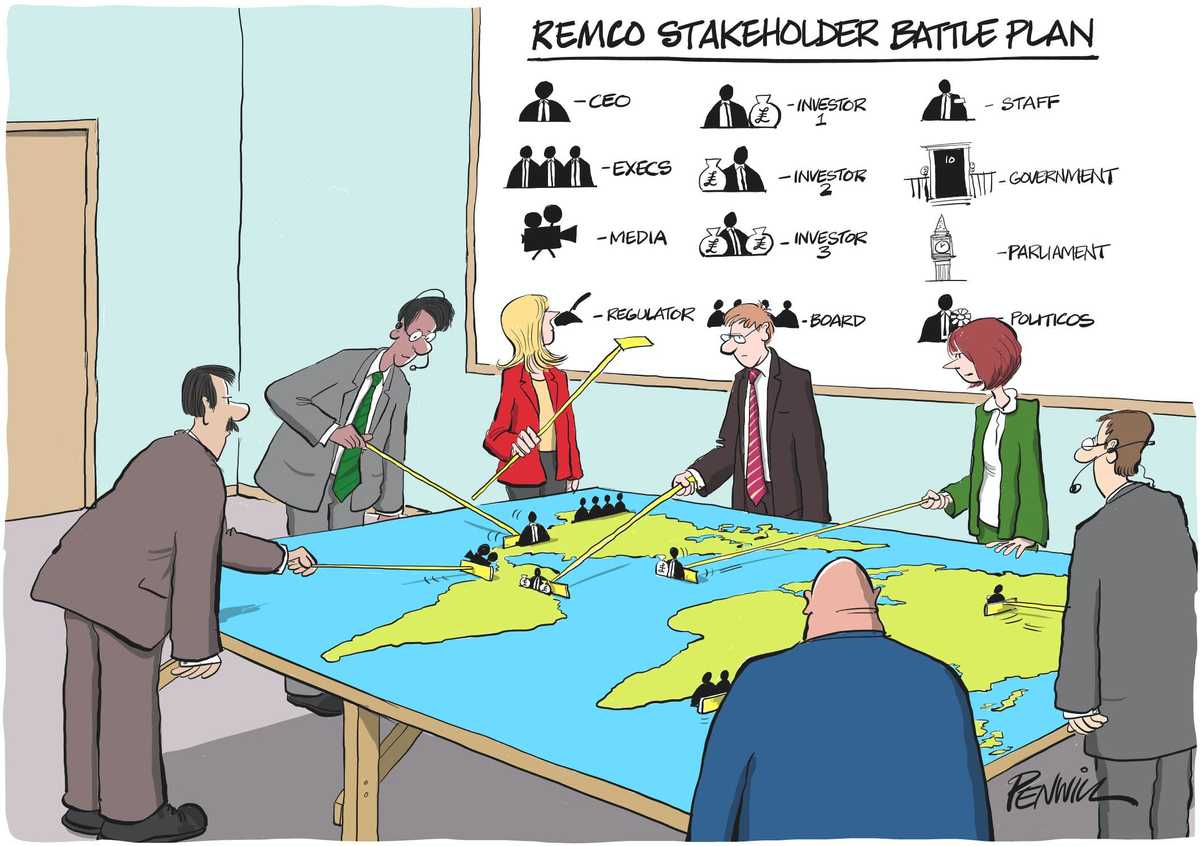

With executive rewards again hitting the headlines, Remuneration Committees remain on the frontline. It’s unlikely they’ll be given much respite, with both investors and the media having got the bit between their teeth. So, even if this year you are one of the lucky ones who managed to get through the AGM season without too much incoming fire, don’t count on it lasting. The only thing you can be sure of is that your chances of pleasing everyone are rather low. And that means you need a well-functioning RemCo – you can’t afford to make life any more difficult than it’s going to be anyway.

Looking ahead to how committees need to work over the rest of the year, we’re bringing you a two-part RemCo special. In Part 2 we’ll look at what needs to work well when the committee comes to designing packages and evaluating the outcomes. But this month we’re looking at effective focus and processes that set up the committee to succeed – and where things can go wrong.

Good practices to consider…

Have the right people in the room (at least until they have to step out). Usually that means the CEO so that the strategic rationale for proposals can be explained. And sometimes the CFO to help explain how financial targets have been met and any measurement issues.

Things to avoid…

Assuming that the HR Director will have a clear enough picture or be in a position alone to justify policies, proposals or rewards. Ultimately the CEO needs to be accountable for what’s being suggested so make sure he/she is properly engaged from the outset, and isn’t just called in on the spur of the moment.

Good practices to consider…

Hold a “strategy half-day” at the right time during the year to help set out the strategic scene, and to share ideas and concerns informally before getting down to the nitty gritty.

Things to avoid…

Thinking it can all be fitted in during the usual board and committee schedule. Often there’s simply not enough time available to accommodate both detailed review and broader thinking – and when that happens it’s the bigger picture discussion that gets squeezed.

Good practices to consider…

Be very sensitive to change: in regulations, market practice, investor attitudes, media interest, reputation risks…as well as, of course, in the business. If there are technical changes in regulation or measurement, annual briefings make sense.

Things to avoid…

Slipping into the mindset that it’s mainly a “soft people matter”. Executive remuneration is technically complex and the underlying measurement won’t be straightforward – and there’s a lot going on outside the business as well. So time has to be invested in keeping up to speed on changes – including the committee chairman being active in attending external briefings and meeting other RemCo chairmen.

Good practices to consider…

Search for the different investor-reaction angles – and allow time for this to happen: investors might have been giving different messages and then respond in inconsistent ways.

Things to avoid…

Leaving it too late to talk to major investors about changes and expectations – and then failing to consider the tactics for dealing with discrepancies or changes in investor mood as the reporting and AGM season progresses.

Good practices to consider…

Ensure that the committee has the right level of support so that high-quality preparation is done in good time.

Things to avoid…

Relying on advisers to make up for a weakness in the company’s management capability. Or even worse, relying on the RemCo chairman and the CEO to take the lead on everything.

Good practices to consider…

Have committee papers – distributed in good time – that enable every member of the RemCo to contribute.

Things to avoid…

Letting the committee become the RemCo chairman’s show, with the others not sufficiently engaged or informed to enable a proper discussion, that takes advantage of the different members’ various perspectives.

Good practices to consider…

From time to time check (again) that the remuneration advisers are really bringing the right expertise, have a good understanding of the business and strategic goals – and have proved to be convincing and effective when working at board level.

Things to avoid…

Settling into a rut with the same advisers even when there are grumblings of dissatisfaction or it’s becoming evident that they no longer have a good enough understanding of, or sufficient interest in, the business and the board’s objectives. The business they started advising some years ago might well be quite different now.

Good practices to consider…

Push the advisers quite hard on their proposals and assessments to make sure they have been properly fitted to the business – and certainly not over-influenced by input from management.

Things to avoid…

Taking market data as a given – or failing to really challenge on how far the benchmarks and structures are relevant: is “the market norm” really that and is it appropriate? Also falling prey to advisers pedalling a standard solution: how far does it tie into what this board wants to achieve? And, of course, lacking in healthy scepticism if they are also advising management.

Good practices to consider…

Invest time in preparation, with the committee chairman taking responsibility for agenda setting.

Things to avoid…

Letting the HR Director’s draft too readily become the accepted agenda. It might be right but even then the committee needs to take ownership and be visibly in the driving seat.

Good practices to consider…

Maintain the right “balance of power” between the committee and the Board Chairman and CEO, both of whom need to be fully engaged without being allowed to dominate. And it means nipping in the bud any attempt by executives to influence outcomes – however subtly or inadvertently they might be doing it.

Things to avoid…

Allowing the meeting to become the CEO’s rather than the committee’s. Or allowing the Board Chairman to operate a “back channel” without involving properly the committee chairman.

Good practices to consider…

Communicate the committee’s reasoning to the rest of the board. If it’s likely to be controversial, keep them well-briefed and consider carefully at what stage and how far the other NEDs need to get involved. Consider bringing the remuneration strategy to the whole board before the RemCo puts a lot of time into operationalising it.

Things to avoid…

Leaving fellow NEDs out of the picture. It might be inadvertent but they won’t appreciate having been kept in the dark if there’s an investor uprising or bad press. And they might be able to help avert controversy by providing different points of view at a not-too-late stage.

Good practices to consider…

Make sure the CEO communicates the rationale of decisions to the executives concerned using messages that would resonate with the committee. It needs to be made explicit – assuming the executives will understand and see things the same way as the committee is usually not very different from leaving them in the dark.

Things to avoid…

Letting the CEO explain the remuneration strategy and targets in terms that aren’t entirely aligned with the committee’s intended incentives. And if executives might be disappointed, this needs explaining and managing – but it’s best to deny the CEO the easy option of blaming the outcome on an unreasonable or investor-shy RemCo.

Good practices to consider…

Make sure the committees are liaising. Audit (and others such as Health & Safety) need to feed in around measurement, control and attitudes to risk taking; Nominations needs to be involved when it comes to appointment, retention and succession planning. Periodic invitations to the other committee chairmen help, and cross-membership is even better.

Things to avoid…

Working in glorious isolation. If other committees have concerns about information quality…controls…ethics and behaviour…safety record…retention… the RemCo needs to know about them so there can be challenge when it comes to KPI assessments.

Good practices to consider…

Ask about the controls and assurance around the figures. That means both when the measures are selected and when results are considered: if a measure is being proposed as a reward component can management explain how it will be measured accurately and subject to review?

Things to avoid…

Simply assuming the figures presented are sound. If they are audited financials that’s OK – but what about the non-audited and non-financial KPIs that might be linked to rewards? This shouldn’t be just a remuneration issue of course – if the thing being measured matters so much that it influences rewards, it must matter for the business and so needs to be correct.

Good practices to consider…

Conduct a deeper, well-structured effectiveness review every other year or so. The RemCo’s role and work are complicated and the strategic and external contexts it is working in are likely to be changing from year to year, so it needs a proper look by someone with the right level of expertise.

Things to avoid…

Letting the RemCo’s effectiveness be considered only by generalist board reviewers. That’s enough much of the time, but periodically it needs to be augmented by getting the committee looked at by someone who understands remuneration as well as governance.

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.