31 May Understanding your Impact on Stakeholders

The debate around what a company is for keeps moving on. The Business Roundtable in the US has announced that a company should exist for the benefit of all Americans, which has brought discussions around stakeholders more into focus. As has the very live boardroom discussions around ESG and what it means in practice.

The Section 172 reporting requirement in the UK is driving this further. Boards have to describe how their actions and decisions have incorporated the views and interests of wider groups beyond just that of shareholders. It’s an opportunity to look closely at how good the story is that you are able to tell. Or you could just approach it as a compliance and reporting issue, but you’d be missing a trick.

The stakeholder angle informs decisions around strategy, social responsibility, and compliance. It’s all part of who the organisation is. Here we highlight some good practices that will help your Board to make better decisions and give it a better story to tell when it comes to the S.172 reporting.

Good practices to consider…

Make a fresh start on the S.172 reporting. Pretend you aren’t doing it for publication (a publishable version can come later) and instead just try to tell a truthful story as convincingly as you can. Then take a step back and identify the weak bits where the story doesn’t hang together or in some way fails to convince. You can make some changes in what you do, and at a later date repeat the exercise to find out if you’ve actually improved things.

Things to avoid…

Starting the drafting with the goal of achieving legal compliance with the minimum of hassle. If you really want that to be your reporting strategy, so be it. But don’t let it fool you into thinking that’s enough. Stakeholders are still going to exist even if you do a barebones report. Trying to tell the story is a great opportunity to understand how good – or not – your story is.

Good practices to consider…

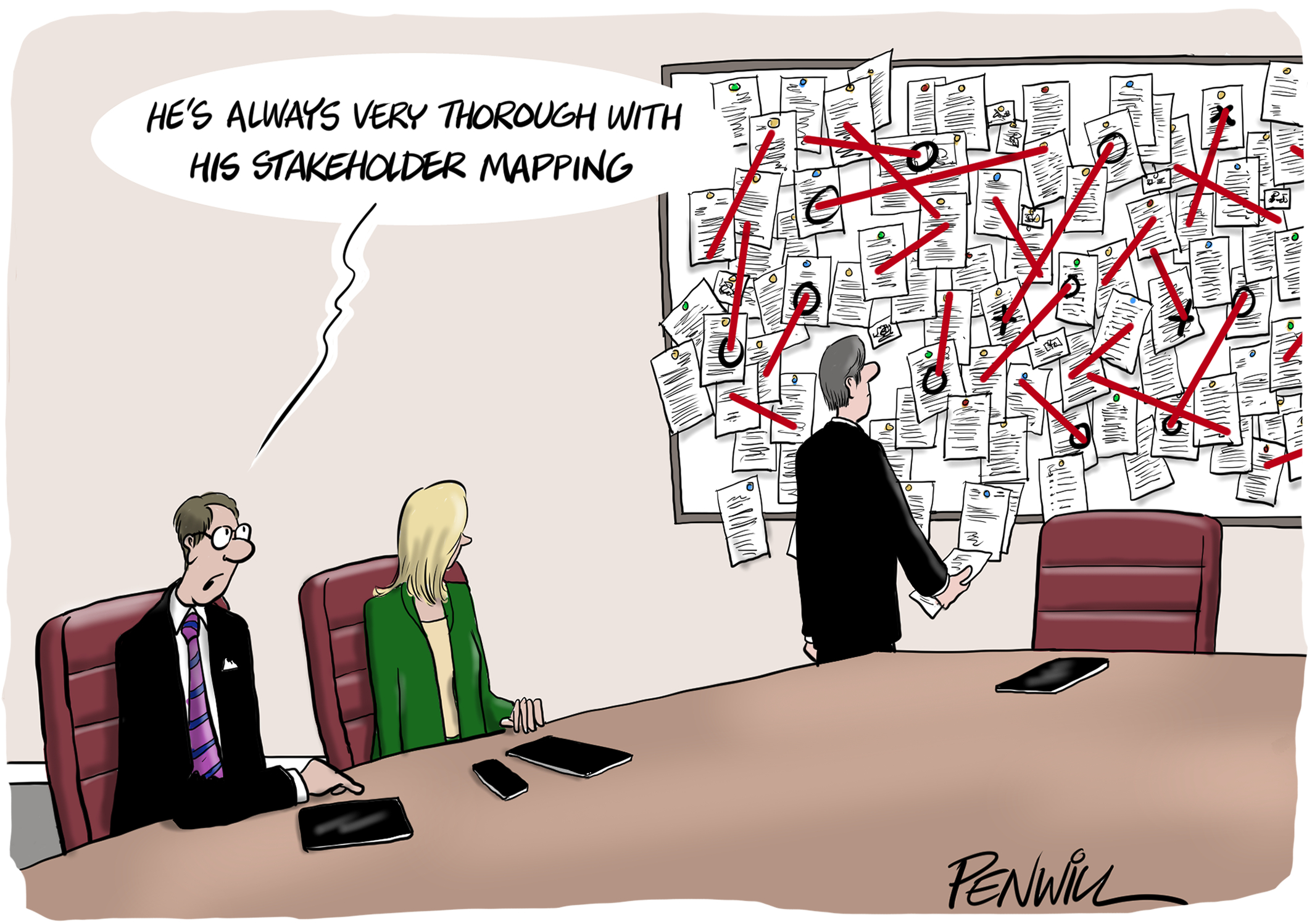

Pin down the stakeholder universe. Universe can be just a posh word for a list, but it’s more deserving of the name if you position them on a chart according to how much they matter. Ask management to set out who your stakeholders are, what their interest in your organisation is and their ability to influence your thinking, contribute to or interfere with your success, or generally cause trouble. Then review this with the whole Board. It’s always a valuable discussion and sometimes produces surprises.

Things to avoid…

Leaving the stakeholder mapping exercise to the Company Secretary. The end result should be something for the whole Board to buy into. And often it turns out that the stakeholder question is not quite as simple as you might at first have thought. A bit of lateral thinking is needed, and all that experience and insight around the board table means the Board should be just the place to get it.

Good practices to consider…

Think beyond what you have always seen as your core group of stakeholders. Most boards are concerned with the interests of shareholders, customers, staff and maybe regulators. But there can be others that the firm needs to have on side. And yet others who are directly affected by the Board’s actions but who have little influence, such as smaller suppliers.

Things to avoid…

Considering only those stakeholders who carry the most direct power or influence over the organisation. Of course, a board has to focus its limited time and energy on key stakeholder groups but the focus should not only be about avoiding headaches. It should consider, with genuine intent, its wider impact. How hypocritical are you prepared to be in saying fine things about stakeholders when you mean only some of them? What is the cost of creating goodwill amongst stakeholders whose relative importance might change in future?

Good practices to consider…

Link the strategy and strategic drivers to your stakeholders. Where are you dependent on stakeholders behaving in a particular way? How might your actions affect them and what sort of reactions should you be prepared for? And how does this picture change over time?

Things to avoid…

Allowing the stakeholder discussion to drift into a rote sign–off, rather than making it an aid to strategic thinking and decision-making. Once you’ve done it in a rigorous way, the value should become evident. If there’s little obvious benefit, maybe you’ve still not got it right.

Good practices to consider…

Take account of opinion formers. The media, social media commentators and influencers might not be listed as stakeholders in the Companies Act, but they have ever-increasing capacity to change shareholder attitudes – for better as well as for worse.

Things to avoid…

Failing to think widely enough about the softer issues of emotions and attitudes to the organisation and how reputation makes an impact on stakeholders.

Good practices to consider…

Appoint a NED-sponsor or “champion” to make sure the stakeholder question is brought into board conversations. This should be a director who can help the Board take a step back to check that wider stakeholder considerations have been factored in.

Things to avoid…

Assuming that every proposal or discussion will naturally include consideration of stakeholder interests. Often, a board will need someone to be consciously nudging it along until it learns the habit of thinking about the impact on a wider group of stakeholders.

Good practices to consider…

Review how stakeholder interests are considered in real time and throughout the year and across the agenda. Stakeholder interests should be a continuous discussion. Much like you wouldn’t leave discussion of risk management to an annual review, or financial health to the annual report and accounts.

Things to avoid…

Letting the stakeholder discussion become simply a post-hoc reconciliation exercise for your Board so you have something to include in your Strategic Report.

Good practices to consider…

Get the Company Secretary to help you see the whole story, by asking them to collate the significant elements of the various discussions the Board has over the year, organised thematically. If you look across your agendas the chances are you are discussing this more than you might think.

Things to avoid…

Not recognising these discussions as they happen. It’s difficult to keep track if you don’t organise the record of these conversations thematically as they happen. And then the Board won’t have a clear and developing picture of how the Section 172 responsibilities are being met.

Good practices to consider…

Use the S.172 statement to help you tell the stakeholder story as meaningfully as possible. Think through the overall structure of the statement. Cross-reference to other relevant aspects of the Annual Report to show that stakeholder considerations do actually exist outside the S.172 report. And give real examples to bring the story to life. And if after all that the story still seems weak, think about changing what you do so you have a better story to tell.

Things to avoid…

Spoiling what might be a good story by telling it in a way that makes it evident the report was drafted simply to comply with the reporting requirements. Make it clear this is not just a box-ticking exercise – unless it actually is, of course.

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.