24 Aug Economics in the Boardroom

It’s no news to anybody that we’re now experiencing some fundamental economic changes. Many non-executive directors are old enough to have memories (possibly of varying clarity…) of going through this before. But others don’t, especially not the younger executives. Interest rates above 1% (last seen over 12 years ago), rapidly increasing inflation (previously accompanied by kipper ties), energy shortages (hence the older generation still keeping a stock of candles at the back of a cupboard somewhere), large-scale industrial unrest…

With such varying experience of disruptions like these, how should boards respond?

Good practices to consider…

Understand the implications of higher inflation rates for the business model. Each organisation will be affected differently depending on the inputs, competition and the extent of price regulation. And it will also vary across products, services or different areas of activity. But certainly everybody will feel the impact.

Things to avoid…

Slipping into overly detailed analysis. The Board will need to stay up at the strategic level but it will be easy to get sucked into discussion of assumptions and interdependencies across the many factors in the model. No –one knows exactly how it’s going to turn out; the important thing is to be prepared for a range of possibilities.

Good practices to consider…

Get a clear picture of the wage cost pressures specific to the organisation. When you put this together with labour market tightness, the strategic implications are potentially far-reaching: costs, pricing, recruitment, staff turnover, production capacity, industrial relations, staff welfare…

Things to avoid…

Assuming that the financial and people pressures are ones that management should and will deal with. These pressures are going to be very difficult to manage and the Board needs to be clear on the possible short-term consequences and the implications for the business model into the future. Nor can you just assume the pricing strategy can take the strain.

Good practices to consider…

Understand how increasing interest rates will affect the present and future interest costs and covenant maintenance, and what impact there might be on lenders’ willingness to refinance and at what cost. Put that together with the strategic issues around holding cash in an environment when in real terms the value of money is being eroded, and asset prices are on uncertain trajectories.

Things to avoid…

Waiting to think through the consequences until management have started putting up the red flags, by which time it might be too late to shift in the direction of a better balance sheet structure. The factors at play are complex and unpredictable but that’s all the more reason to engage with management at an early stage and help think through things together.

Good practices to consider…

Think through what will be happening across key external relationships. That might mean understanding better the business or production life cycle of key suppliers, so that the main effects on them, and therefore on us, are foreseen. And of course the pressures on major customers need to be understood too as the knock-on effects will be felt at some point.

Things to avoid…

Staring only at the company’s own navel. Some suppliers will struggle from the effects of rising interest rates and increasing inflation. How will their reliability and pricing strategies be affected? What contingency plans are there if important suppliers fail or restrict deliveries?

Good practices to consider…

Think through the impact on stakeholders. They too are affected by the changing circumstances, and this is likely to provoke changes in their expectations of you. Reputational risks can also change suddenly if the press see an opportunity to portray your company as profiting from others’ distress. The “S” in ESG comes more to the fore in tough times, so the Board needs a clear view on what it sees as its responsibilities, strategic interests and reputational risk exposure.

Things to avoid…

Assuming that those stakeholders who are suffering will muddle through, so there won’t be any substantive impact on our business or activity. Depending on your sector and customer base, that’s looking pretty unlikely. Of course, the Board can’t make a call on the precise impact. But it should be checking on management’s thinking. As well as making sure management have formulated a response around the social impact and our social responsibilities.

Good practices to consider…

Factor in the political pressures. As the heat is turned up even further on the politicians, they’ll want to divert attention onto others. Not only onto commercial organisations: public service bodies will have to work just as hard to make sure grim headlines don’t appear.

Things to avoid…

Failing to spot where the political pressures are going to come from. You might not be able to prevent them, but if you’re prepared and have a messaging strategy ready to go, you’ll be in a much better place. The Board can help both in anticipating the pressures and road testing the responses.

Good practices to consider…

Work out how to plan and budget in an inflationary environment. Just indexing last year’s is unlikely to give the best answer… and assessing performance against the usual benchmarks is a different game in an inflationary environment, which offers a wide variety of opportunities for obfuscation over the true underlying performance.

Things to avoid…

Carrying on in the same way that has worked well for the past 10 years and more. Management need to work out how to measure the true economics of the business and identify the pressure points. And both management and Board need to get used to greater uncertainty and ambiguity in looking ahead.

Good practices to consider…

Keep an eye on the pricing strategy and how margins will be affected and managed. And as part of that, a keener focus of competitor pricing might be needed.

Things to avoid…

Again, getting too close to the detailed analysis. It’s up to management to make changes, and not the role of the Board to second–guess them. But from a strategic perspective, the Board is going to need to have confidence that management are responding in a timely way as inflationary pressures increase. And that they are managing effectively the risk, so the business is neither losing sales value by lagging the market nor losing market share through over-aggressive price increases.

Good practices to consider…

Get comfortable with scenario planning. Yes, we are dealing with the unknown but that is what will need to be managed. Companies that do scenario planning well always find it useful. If that isn’t your experience, consider whether it was actually done well, and how to try again and succeed this time.

Things to avoid…

Regarding scenario planning in the boardroom as a bit of a waste of time because of the unknowns. The future is, of course, unpredictable. But the process of thinking through what might happen surfaces a range of situations or risks that will stimulate thinking about how to run the company better.

Good practices to consider…

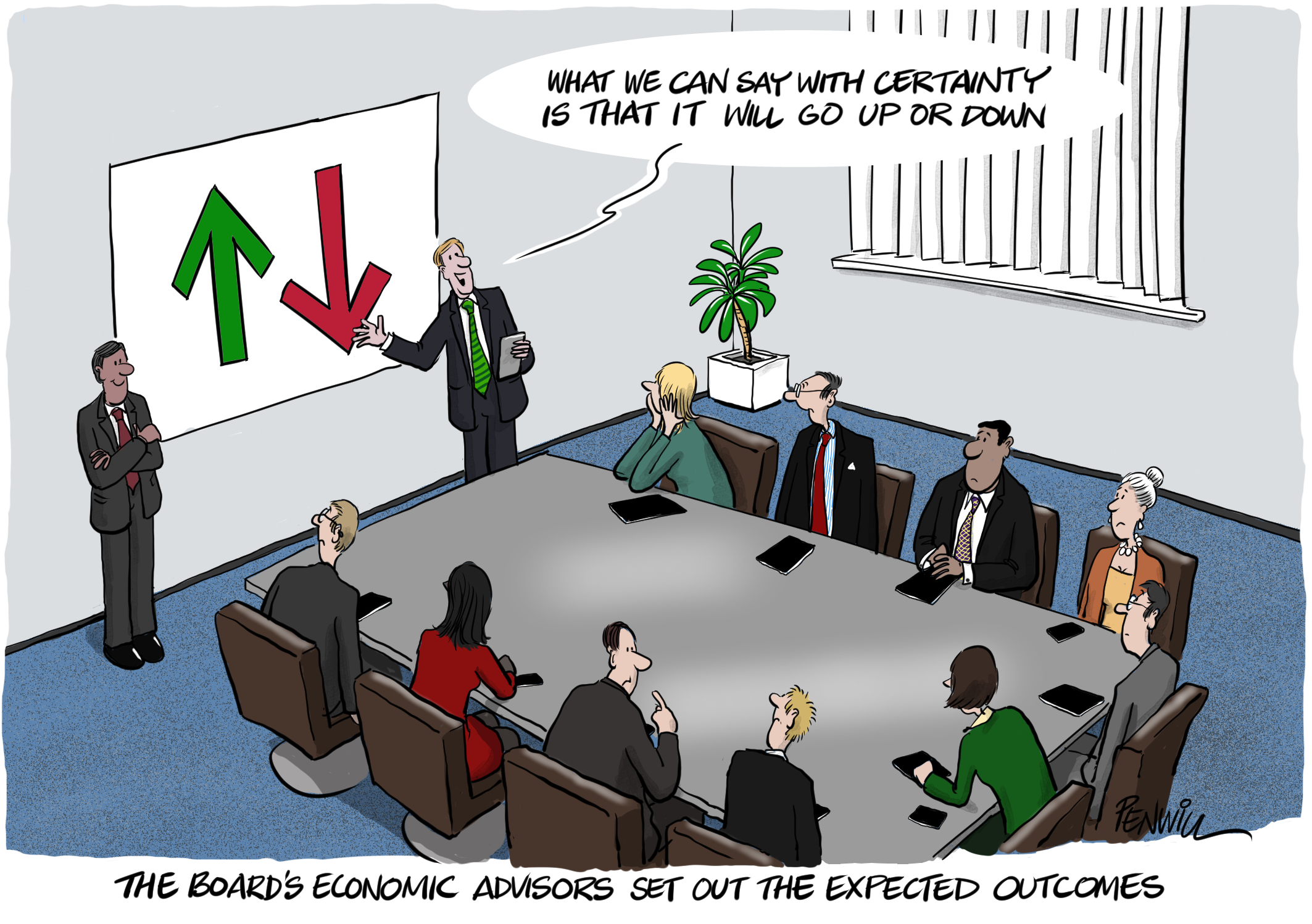

Check on how economists are used, both by management and by the Board. We all know that expert opinions and models vary. And good economists themselves will always flag up the uncertainties, even if only in the small print. But at the very least their expertise can put the spotlight on the main drivers of economic change and help put the uncertainties in context, which will prompt debate and put the spotlight on critical issues. So the Board should know how management are receiving and using advice, whether from the bankers or other advisors, or from an in-house team.

Things to avoid…

Supposing that, because economists usually get things wrong, you’re no worse off flying blind. Working out the impact of major influences needs expert input, ideally from a range of viewpoints so that the inherent uncertainty is clearly portrayed. It’s usually helpful to bring an economist (or two) into the boardroom now and again for a briefing and discussion. Just make sure they know they’re there to help the Board think through the challenges and uncertainties, not to offer the false comfort of spuriously certain forecasts.

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.