01 Feb The temperature rises in the boardroom

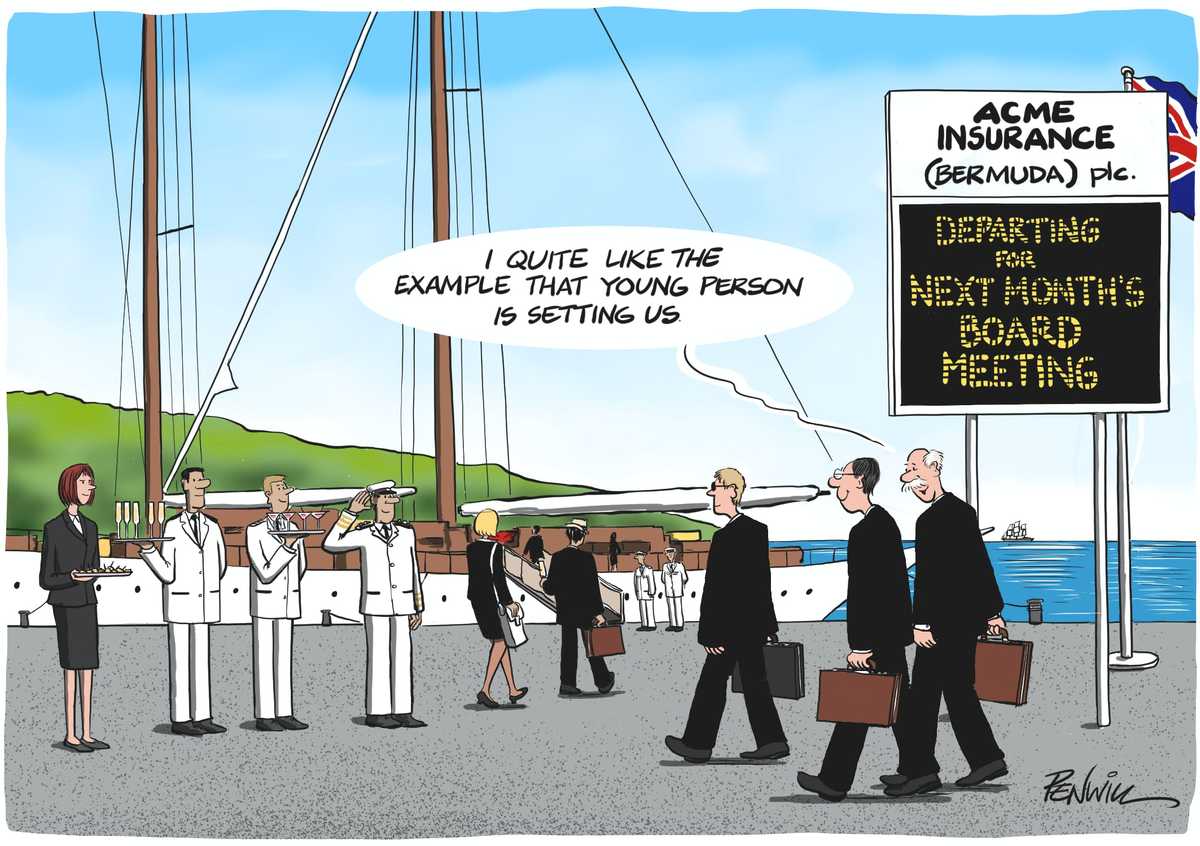

In a month when the new CEO of BP has announced his company’s intention to achieve net zero carbon emissions by 2050, our regular bulletin is taking a leaf out of Greta’s book and going green. What is a board to do? Regulators are already making their expectations clear, so, for anyone who is a director of a financial institution, climate change has shot towards the top of the agenda. But at our non-FS clients, we see various shades of green in the boardroom and, at some, a distinct absence of green at all.

In this month’s Bulletin, we’re not going to debate the science: what matters is that a shift has taken place. Climate-change activism may have been a peripheral movement a few short years ago but, now, there is an increasingly mainstream call to action. The political, investor and customer winds have shifted. So whether you’re a believer or still a bit of a sceptic, every board should be driving their organisation’s focus on this important topic and every director must be able to state what their organisation is doing about it. Here are a few suggestions as to how to go about it – and some potential slip-ups to avoid.

Good practices to consider…

Discuss the impact you have – or at least agree with management how they are going to go about assessing it and what’s possible. Many organisations can now measure how much carbon they emit, water they use and pollutants they release in the course of producing their products or delivering their services. If your executive team can’t tell you this, they’re behind the curve – and in a poor position to take action. Make sure you’re getting the data, that it gives a clear picture and that climate risk impacts are incorporated into your regular risk reporting.

Things to avoid…

Not measuring as a way of avoiding facing the facts – or hoping to avoid others noticing. Taking the narrow view is increasingly unacceptable too. It’s not just about your office building or even your factories. What’s the impact of your supply chain, contractors and outsourced services? What does the consumption of your products do to the environment and what is the impact of the companies you invest in?

Good practices to consider…

Agree on what standards you’re seeking to meet. As a Board, you should be asking what the relevant environmental regulations are, seeking assurance that you’re meeting the requirements and checking that breaches are being reported at Board level. But regulation is only part of the story…

Things to avoid…

Taking the view that meeting regulatory standards is enough. In some fields, societal views are moving much faster than public policy and regulation – so it’s now a matter of “strategic standards”. It might be legal but your reputation could well take a hit if you’re not starting to deliver a different story.

Good practices to consider…

Listen to your people. They are a readily accessible source for finding out what others might be thinking. And keeping talented employees, especially younger ones, increasingly means proving to them that you’re a responsible employer, doing the right thing for the environment. In the war for talent, environmental credentials are becoming a serious weapon.

Things to avoid…

Not asking them in the hope they won’t point out uncomfortable truths. Or simply not recognising the potential of a ready-made “focus group”. That’s a missed opportunity to get insight and also to show your workforce that you do actually care.

Good practices to consider…

Work out a well-debated position on why you care. And on what you’re going to do as a caring organisation. In other words, make sure your strategy is underpinned by sound reasoning that is believed by the Board and believable to internal and external stakeholders.

Things to avoid…

Doing “something” because “everybody’s looking at ESG” – rather than making sure it is underpinned by a convincing argument. That might be purely based on strategic, commercial and political logic or it might reach far into the moral territory of “doing what’s right”. There’s no right reasoning as such, but a Board needs to know how and why it’s adopting the stance it’s advocating.

Good practices to consider…

Create the space to weigh up the reputational risks of your activity and output. “We’re meeting market demand” is no longer enough. It may well have been an acceptable narrative to state that you were merely meeting the needs of responsible adults – while making them aware of the dangers. But this approach is becoming increasingly unjustifiable from a brand and reputation perspective.

Things to avoid…

Maintaining your traditional mindset as the world changes around you. Even if your mainstream clients still value your product and demand it, a vociferous minority can turn them rapidly against you. You might be able to brush off a sportsman who no longer wants your logo on his shirt. But the impact of a few loud voices on your reputation and, ultimately, your clients’ loyalty can be significant. Helping management spot the shifts is an important part of a Board’s strategic oversight.

Good practices to consider…

Maintain a clear picture of how stakeholder attitudes and interests are changing, particularly the institutional investor view. For them it’s no longer a clear-cut question of sacrificing returns in order to invest responsibly. Added to that, they are starting to see an increasing regulatory push around managing the climate-related risks in any investment portfolio.

Things to avoid…

Failing to appreciate in good times how the shareholder sands are shifting. Your markets may still be expanding, and profits could be good, yet the share price stubbornly refuses to rise… Has the paradigm shifted? Is it possible to deliver shareholder value if your environmental strategy isn’t credible – or isn’t perceived to be so? As a Board, you need to consider if you’re willing to take that risk.

Good practices to consider…

Examine the organisation’s values and mission and how a general will to be environmentally responsible is permeating down into real strategic priorities and actions.

Things to avoid…

Failing to challenge management on how the agreed environmental approach has become an integral component of your purpose and priorities. Taking small steps that are symbolic rather than transformative might be OK, but are they adding up to a credible stance that is actually implementing the shifts that have been agreed and communicated internally and externally?

Good practices to consider…

Articulate your story well, explaining what you’re doing and why. Writing the story is management’s job, but it’s up to the Board to check that it’s believable, understandable and in line with what has been agreed as part of the purpose. And the NEDs need to do a sense check to make sure it’s easy for clients, investors and employees to understand what’s being done to be responsible and sustainable.

Things to avoid…

Assuming the outside world will see it and that it’s obvious. It probably won’t be. And healthy scepticism from the Board can help avoid the potentially lethal error of “greenwashing” – announcing lofty goals without any clear intention of achieving them. If you hype up the story without the deeds to match the words, you can end up undermining confidence that will take a very long time to rebuild.

Good practices to consider…

Make sure you are working to clear goals and targets. This is easier said than done since there are many standards and measures out there. Different agencies and investors, pressure groups and NGOs are assessing sustainability in different ways. So it’s important to challenge executives on what they are measuring and why – and assess if it’s a credible picture. Be prepared to show progress and to compare yourself to others. This means deciding which organisations you want to compare yourself to and figuring out how you stack up now.

Things to avoid…

Allowing the unclear situation on standards to stop you taking action. The narrative is important but, without the evidence of KPIs and measures, you will struggle to convince anyone you’re serious. Do you want to be better than the worst, middle of the pack or the best on your environmental impact? And how are you going to prove it? You can only “get things done” and make it a priority if you turn it into a set of sensible KPIs. It’s up to the Board to push for this – and then to actually use the measures regularly to ensure that momentum is being maintained.

Good practices to consider…

Take the time to understand the limitations and what you can’t realistically achieve. Balancing stakeholder concerns means exactly that and any organisation has competing demands. Adapting can have unintended consequences or introduce unacceptable stresses for suppliers, the workforce and for customers. So, consideration needs to be given to how quickly and “responsibly” you can expect to adapt without various groups suffering serious consequences.

Things to avoid…

Going overboard on the environmental push to the detriment of other critical priorities. You have to consider the costs – both financial and human – of making the transition to become greener. Those who make out that it’s a straightforward choice are often over-simplifying a complex picture. But, despite this, any Board has, as a minimum, to be asking itself the question: “How much can we afford not to do?”

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.