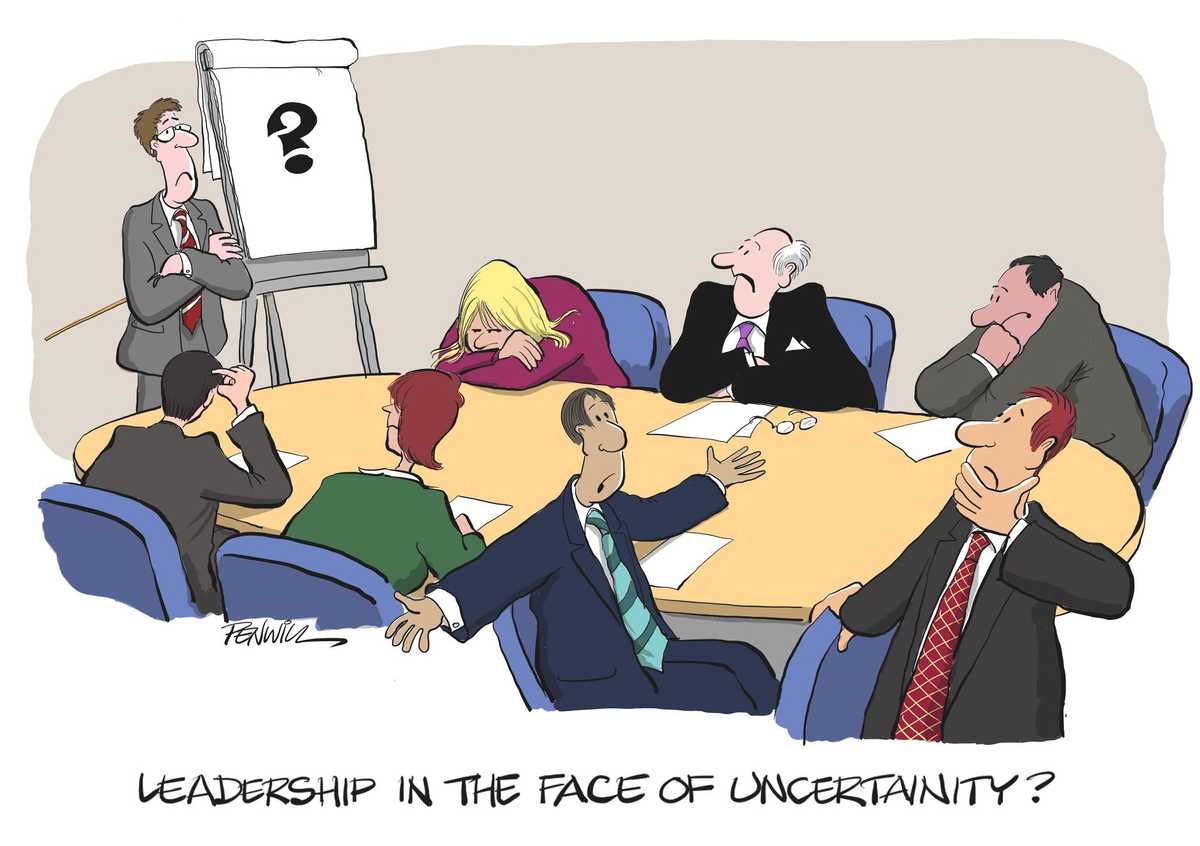

01 Oct Dealing with Uncertainty

Whether it’s recent challenges from Brexit or exchange rates…or long lasting change such as disruptive technology and speed of events…boards now just have to accept that they are constantly dealing with uncertainty. But crisis – at time prolonged – brings its own challenges. Last month we hosted a chairmen’s discussion on how best to deal with uncertainty and disruption. We were given plenty of food for thought on what boards might need to do – and to avoid doing – in these uncertain times.

Good practices to consider…

Recognise that the only certainty is that there will be uncertainty. So think through the response before it happens – whether it’s as soon as choppy waters are visible or simply working off the assumption that a storm will hit. A board and the executive team should know who is going to take what steps in a crisis and in what sequence.

Things to avoid…

Assuming you can simply deal with it when it happens, hiding behind the excuse that there’s not much point in planning until you know the nature of the problem. We still see many boards where contingency planning is weak or non-existent, whether it’s the proverbial bus taking out the CEO or that cyber attack that leaves you with worse than egg on your face.

Good practices to consider…

In response to longer-term uncertainty (not just responding to crisis) think through how the business and the board can work with other companies to strengthen the collective position. Maybe it’s in the face of Brexit or of political positioning versus “business and boards” – or some other common challenge. Whatever it might be, there are times for investing in the common good and boards need to think about what might be needed in a structured way.

Things to avoid…

Forging a lone – and lonely – furrow. The headwinds in uncertain times can be strong as well as unpredictable so standing together will make more sense. Boards should keep a watchful eye on opportunities to communicate and co-operate with fellow corporate leaders. It doesn’t have to result in co-ordinated action but directors should be thinking through the possibilities and potential benefits. (All, of course, without anything that might be seen as collusion or distortion of competition.)

Good practices to consider…

Don’t underestimate the speed at which problems develop – and make sure your contingency planning reflects this.

Things to avoid…

Adopting a “it’ll be alright on the night” stance. It may well be – but some judicious foresight and planning will significantly improve the chances. Boards should be asking for clarity and reassurance about the plan.

Good practices to consider…

Ahead of time have a clear idea of the role of the chairman when the storm hits – and how that fits with what’s going to be needed from the CEO. There are many angles: communication, co-ordination, confidence-building, to name just a few.

Things to avoid…

Most chairmen and CEOs have worked out a good modus operandi for business as usual. But how far will this stand up in a crisis – or even in less dramatic circumstances: is it really what’s needed as uncertainty increases? Is more time, communication, support…maybe challenge…needed?

Good practices to consider…

Throughout it all, focus on the customer. Whether in the immediate fallout or managing the longer-term aftermath, doing right by the customer is likely to set the ship on the right steer.

Things to avoid…

Slipping into a wholly internal focus. Managing internal stresses will of course be important but customers will be under stress too. Keeping those markets and relationships will ultimately be key.

Good practices to consider…

Appreciate that trust, authenticity and transparency will become of paramount importance in a crisis: throughout reporting lines, with employees, customer and suppliers – and in being able to rely on a solid “corporate social responsibility” position.

Things to avoid…

Adopting a strategy of obfuscation and opacity in response in an attempt to paper over difficulties. Avoiding an immediate loss of face might be at the cost of a longer-term loss of confidence. Management may not realise they’ve gone down that route so it’s up to the independent view from the board to help management calibrate the message.

Good practices to consider…

Do what you think is right. (Or “be pure” as one chairman put it.) In a crisis the moral compass is particularly effective. And if it means you miss a few tricks, that may well be okay in the long run as you can at least claim to have “done the right thing”.

Things to avoid…

Being tempted to take moral short cuts. Some decisions will be hard but standing back and testing your thinking against “what’s right?” helps. So this is where the board needs to be very present, constantly testing behaviour against principles and if necessary giving executives the courage to follow the right path.

Good practices to consider…

Bring “reputation” much further up the board agenda. Uncertainty requires careful listening and thinking – and pausing for thought (and discussion) about what you need to do to emerge with your reputation unscathed, or at least to minimise the damage.

Things to avoid…

Focusing on the detail of the risks without thinking through the reputation risk and how that needs to influence both the strategy and the detail of the response. Too often we see boards looking at the operational and financial consequences of the principal risks without factoring in the short- and longer-term reputational implications.

Good practices to consider…

Once you’ve emerged from the immediate tension, objectively assess what reputational damage has been done and what’s needed longer term to put things right. And it’s the board that’s well-positioned to bring that independent and rigorous challenge.

Things to avoid…

Blaming everybody else – or simply coming over as the victim of circumstance. There may well be some – or a lot – of justification for that. But being right isn’t necessarily going to help you in the court of public or political opinion. The board should work out with the executive the “big message” approach and then adopt a watching brief to make sure the organisation as a whole sticks to it.

Good practices to consider…

Recognise to the full that you’re going to have to be tough. A crisis needs the board to step up to the plate, possibly taking some directors and the wider executive team into new areas of discomfort. If this is explicitly acknowledged, it’s a less difficult path to tread.

Things to avoid…

Delaying and dithering. Sometimes holding back on a decision to wait for the situation to become clearer might well be justified – but boards need to constantly be aware of the potential consequences of such a judgement call. Cash will be king so that – combined with “doing the right thing” – should be maintained as a test to make sure that hard decisions are not unjustifiably postponed.

Good practices to consider…

Keep looking forward and keep hold of the fundamentals. They shouldn’t change much even in stormy weather: strong management systems, a good offering, a customer focus… these should stay strong. And that might mean focusing on some “slow burn” strategies that might appear to be low priority in the circumstances – such as staff education, social contribution, future marketing…

Things to avoid…

Letting board meetings become fully focused on the immediate problems – and losing sight of what is at the core of the business. The board needs to help keep that focus, lifting sights above the immediate issues and to see the waypoints that need to be reached to get to a more stable long term destination.

Good practices to consider…

Maintain a strong sense of ownership of the problem, of the solution – and of the business. This is where the board’s leadership will come into play – reassuring the executive, bringing the top team together, setting a clear example of confidence and determination.

Things to avoid…

Becoming despondent at a time when management need leadership and the executive are most likely looking for inspirational support not signals of sympathetic despair. If management seems in danger of wallowing, that’s the time for the board to step up and try to set a positive tone.

Good practices to consider…

Stay agile. A board will need to adapt what it does, playing a different role for a while. That probably means getting closely to the detail (whilst not undermining the executive) to make sure that things are watertight and bringing experience to bear. But once normality resumes, it also means retreating into the oversight role and letting management get on with it.

Things to avoid…

Carrying on as usual by keeping to the same agenda structures, meeting routines and style of discussion. The board needs to retain its independent oversight role but that doesn’t mean it can’t for a time get closer.

Download This Post

To download a PDF of this post, please enter your email address into the form below and we will send it to you straight away.