Guidance Archive

Third Party Risk

![]()

More than ever, most companies’ fortunes are dependent on third parties. A myriad of suppliers make the wheels turn and often provide many of the inputs. Organisations typically have little influence over the way these suppliers behave, other than as a buyer who can make some noise.

Stakeholder Stimulation

![]()

There are so many reasons to take a well- structured approach to giving stakeholder considerations the right amount of time and attention. It’s not just about meeting requirements.

Standing Back!

![]()

During our board effectiveness reviews we often hear the refrain “we don’t spend enough time standing back”. In other words, creating the space to just think and talk about the bigger things that are happening around us that might have an impact.

It’s time to take stock: looking ahead to 2024

![]()

It’s time for us to stick our necks out again…

Artificial Intelligence: Getting on the front foot

![]()

It’s one of the hottest topics around. The world is starting to wake up to the risks and opportunities of Artificial Intelligence (AI). And yet one place where we are seeing little discussion is the boardroom. In fact, in a recent webinar that we took part in, half of the company secretaries present said their boards hadn’t discussed it at all.

Risk Oversight: Board or Committee?

![]()

Risk governance is complex enough without any added fuzziness around who should be doing what and how. And the more layers of governance there is, the more potential for fuzziness. Board Risk Committees (BRCs) became common after the 2008..

Here we go again: banking risk

![]()

A good number of boards suffered a very uneasy weekend in early March. It wasn’t only the directors of Silicon Valley Bank who were stressed: many of its customers found themselves exposed.

The Tech Deficit

![]()

You would be hard pressed to find an organisation that doesn’t see technology as a strategic driver.

What does 2023 have in store?

![]()

Well, 2022 was certainly a rollercoaster of a year. On every front – geopolitical, macroeconomic, social, national political and more – Boards have had to respond to rapidly changing external environments.

All about the Customer

![]()

Developments in the financial services sector have a tendency to spread into the wider world of governance (just look at risk management!) So it makes sense for all boards to pay attention to how the regulators are putting the consumer front and centre.

Stressing the Business Model

![]()

Are you rigorously thinking through how your business model is being impacted by the multi-fronted economic crisis?

Economics in the Boardroom

![]()

It’s no news to anybody that we’re now experiencing some fundamental economic changes. Interest rates above 1%, rapidly increasing inflation, energy shortages..

Watch out for your reputation

![]()

Value destruction comes in many forms. A hit to your reputation is often a reliable way of taking a hit to the share price or to morale, or to both

Understanding your Impact on Stakeholders

![]()

The U.S Business Roundtable has announced that a company should exist for the benefit of all, which has brought discussions around stakeholders more into focus.

Breaking Silos

![]()

Most organisations bemoan silos. Everybody seems to agree that organisational structures which give rise to operational obstacles are A Bad Thing…

Stress Management

![]()

Many of us will deny we’re over-stressed even though it’s what we’re feeling. So we try to hide it and deal with it alone, even when we know we shouldn’t.

Understand your Business Model

![]()

Do you really understand what makes your organisation perform (well or badly)? How it all hangs together? What needs to happen. Where the big costs lie?

Working From Home: The Risks of the new Normal

![]()

Boards’ immediate concerns about the risk and control implications of Working From Home have been calmed and hybrid working is set to become the norm.

Hot Topics for 2022: What other boards are missing

![]()

As 2021 comes to an end, boards are thinking ahead to 2022. They’re thinking about what lies in store. Further uncertainty for sure. But on its own that’s not very helpful as an agenda item.

What are board meetings for?

![]()

We see a lot of boards in action. Sometimes it’s an enjoyable and stimulating experience. Other times we find ourselves asking “what was that meeting supposed to have achieved?”

Board meetings: The Hazards of Hybrids

![]()

Boards are all very keen to meet together in the same place, and it’s beginning to happen. But the next few months will continue to be unpredictable and demand flexibility.

Board Training: it’s tricky

![]()

For some directors training is still a tricky topic. Maybe it’s the word that puts them off – perhaps a feeling that they’ve done enough training…

Away Days: Back To Normal?

![]()

It might be a bit difficult to remember what was “normal”. But, back then in the pre-Covid world, most boards normally had the annual strategy day (or two) as a fixed item in the annual calendar.

Position it!

![]()

Board papers are a perennial challenge. That makes them a reliable topic in board evaluation reports. First the good news:…

Third Parties: do we know what’s happening

![]()

For a long time now it’s been widespread practice to depend on third parties for operational support – and sometimes on a very big scale. Outsourced operations, services, systems support, staffing, assurance checks

The Principal Risk Discussion: what’s it for?

![]()

For many boards this is the time of year for finalising the Annual Report. So that means, at least for the UK listed companies, that it’s time for the principal risk list

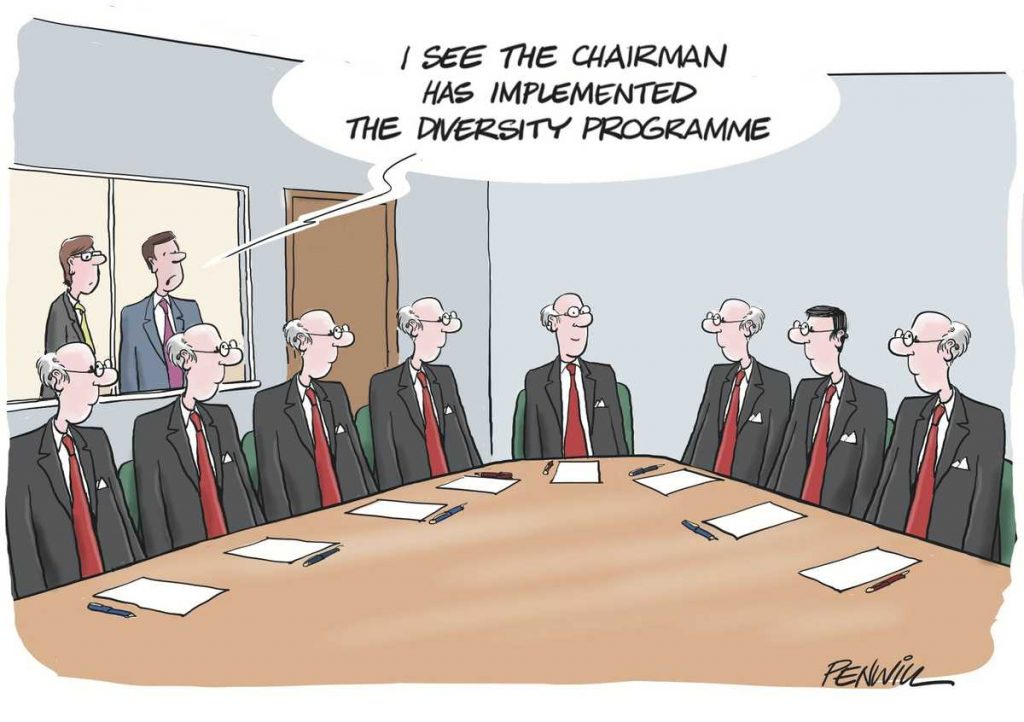

Diversity & Inclusion and Boardroom Performance

![]()

Boards with increased diversity create leadership environments in which decisions are made more carefully

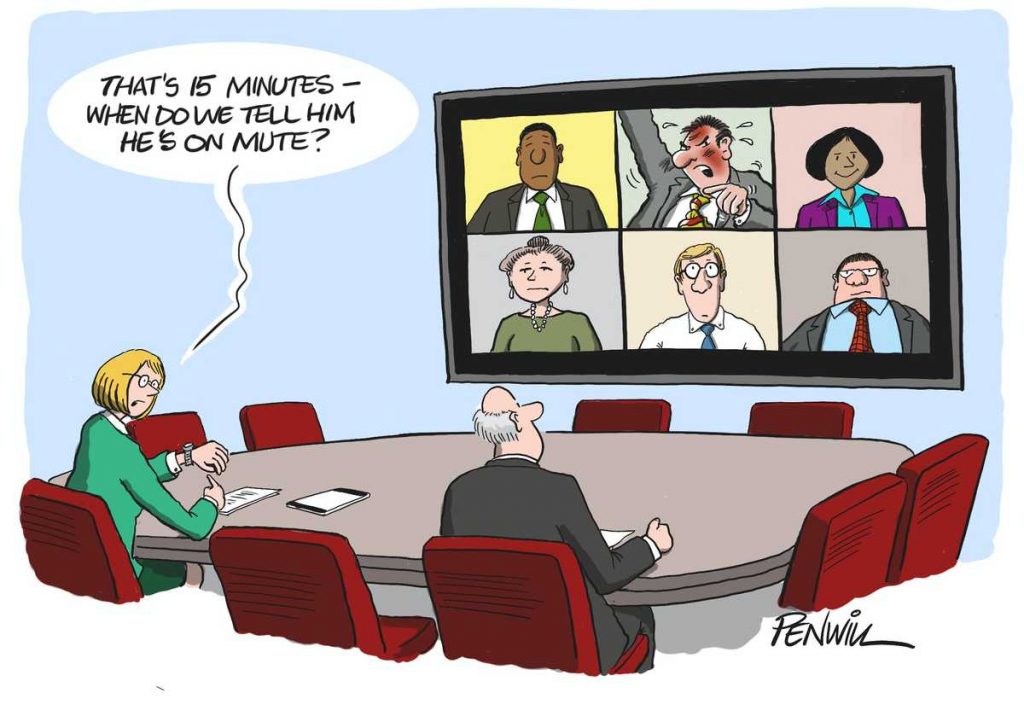

On Screen Meetings: Take Two

![]()

It’s worth taking another look at how to optimise virtual meetings

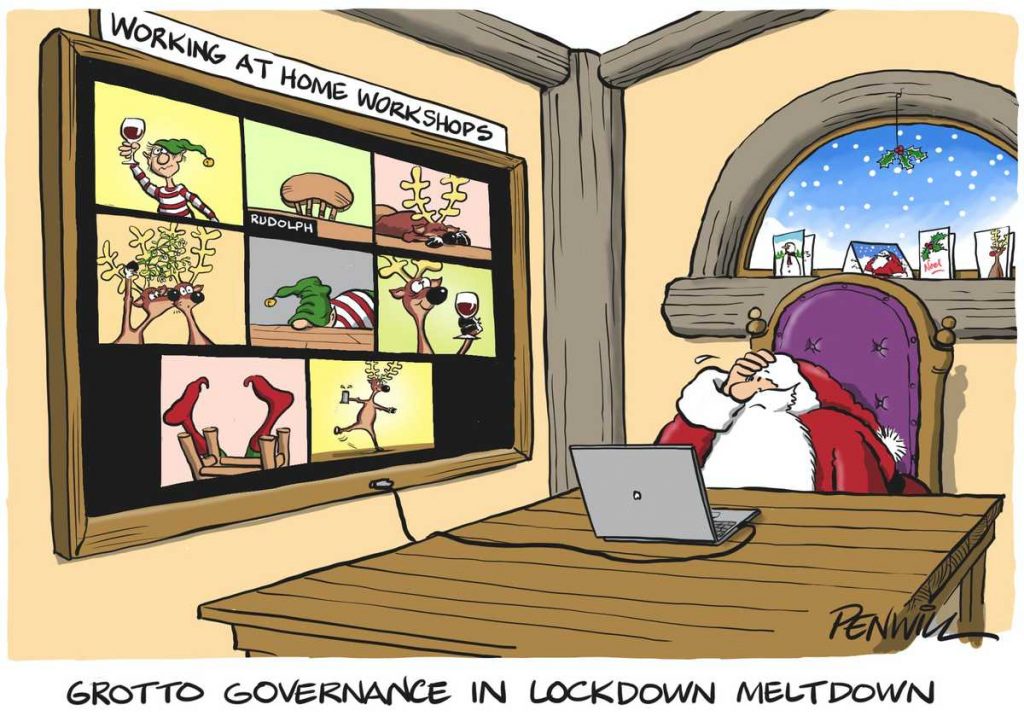

2020 Shock? Take Stock

![]()

Boards should take stock over Christmas and consider what’s needed for 2021

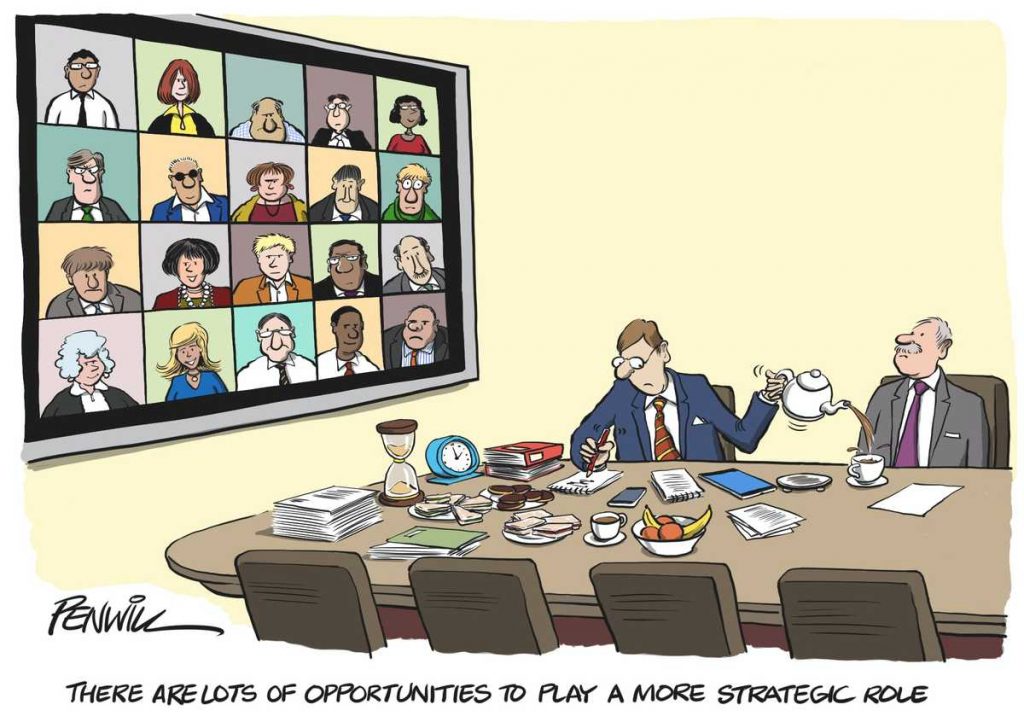

A more strategic role for the Company Secretary

![]()

The Board can help the Company Secretary add more strategic value

Decision-making in a virtual world

![]()

Making sure of sound governance around decision-making in a virtual meeting world

Risk management, control and COVID-19

![]()

Audit & Risk Committees need to make sure risk and control remain solid in the COVID-19 environment

Rethink and reshape the way you work

![]()

Virtual meetings mean a different focus – and that means changing the agenda and papers

Cyber risk questions the Board needs to ask about COVID-19

![]()

Boards need to be asking about changing risks and controls with COVID-19 and Working From Home

Making virtual board meetings work well

![]()

Virtual board meetings need different ways of working

The temperature rises in the boardroom

![]()

Environmental challenges and the strategic response need to be higher up board agendas

Assessing external audit effectiveness

![]()

Audit Committees need to take a structured approach to looking at external audit

Board life in 2030?

![]()

A look into the future: thinking about how boards might work come 2030

Listening to the employee voice

![]()

A look at the role of the non-executives and how best to capture employee views

Overseeing Internal Audit

![]()

How Audit Committees can look at the effectiveness of internal audit

9 Steps to a better board review questionnaire

![]()

A guide to better board evaluations when you’re using questionnaires

8 ways to get the most from your strategy away day

![]()

Making your strategy day work well is not easy so we share some tips

More than bean counters

![]()

Assessing the Finance Function is a strategic issue and not just about control

Cyber risks – what a board should be asking

![]()

The questions to cover, including some the Board might not have thought of

Joy or dread? How do you feel about your board pack?

![]()

Practical guidance on how to structure board papers better

The Ins and Outs of Private Sessions

![]()

Non-exec only sessions are important but can go wrong: some tips on getting them right

Order, order! How to run a good Board meeting

![]()

Chairing a meeting is difficult: some tips on what works well

The New Code: Spotlight on the Principles

![]()

How boards should respond to the emphasis on Principles and what the business is for

Thinking of Others

![]()

It’s getting ever more important to think through how the Board is considering stakeholders

De-stressing and Stressing

![]()

The value of scenario discussions and stress-testing should not be underestimated

Director Performance Review

![]()

Individual director performance reviews can be tricky: we take a look at how to get it right

(Audit and) Risk Committees

![]()

The work of the Risk Committee needs careful structuring around responsibilities and agendas

Bias in boardroom decision-making

![]()

Boards run the risk of unconscious bias in their discussions and decision-making

Board portals: some Do’s and Don’ts

![]()

Board portals have transformed life as a NED – but there are pitfalls and care is needed

Management in meetings

![]()

The way boards involve the management team in board meetings could often be better

Committees and Risk

![]()

It’s important to make sure the different roles around risk at board level are clear

The CEO Report

![]()

Starting the board meeting with an effective CEO Report makes a big difference

The Hygiene Factor: Getting Meetings Right

![]()

Thinking through the practicalities of making the board meeting work well

Is your risk management truly effective?

![]()

The Audit Committee needs to look at the impact of risk management, not just the process

Subsidiary boards – it’s not that simple

![]()

All too often the effectiveness of governance in subsidiary companies can be an afterthought

Dealing with Uncertainty

![]()

Thinking through what might happen needs better scenario decision and board time

In danger of being caught short?

![]()

A lot companies are getting into the habit of planning their board reviews earlier

Remuneration Committees: Avoiding the pitfalls

![]()

It’s easy for the RemCo to get things wrong given the spotlight and the complexities

The best way to assess organisational culture

![]()

Highlights from our research for the FRC on what boards are doing around “culture”

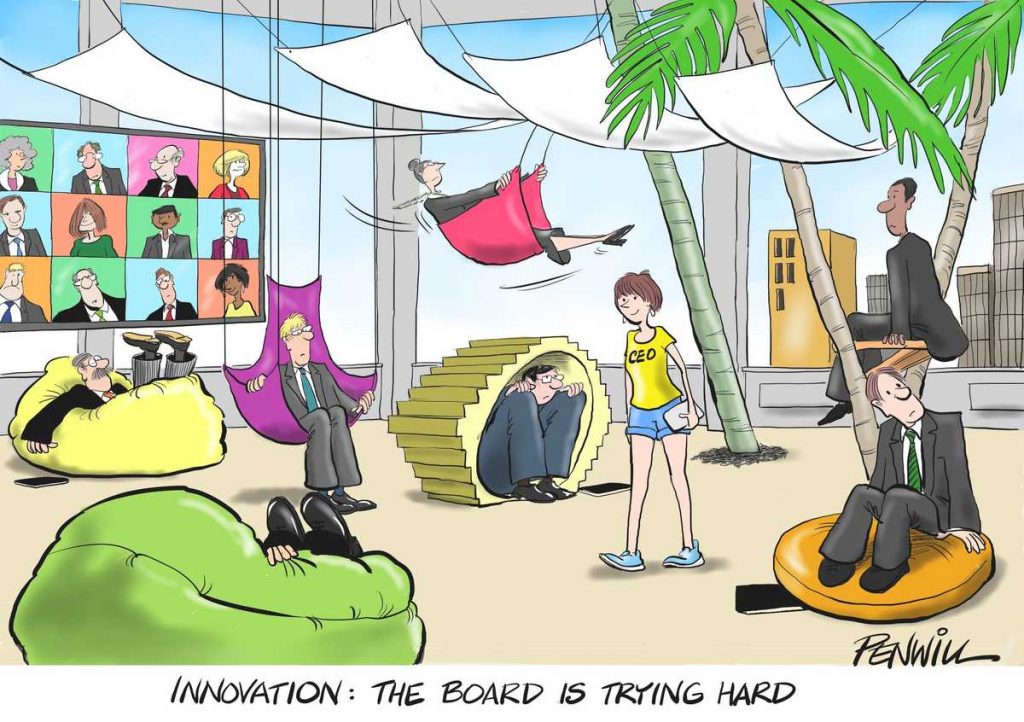

Innovative Innovation

![]()

Boards talk about the vital importance of innovation but does it get enough focus

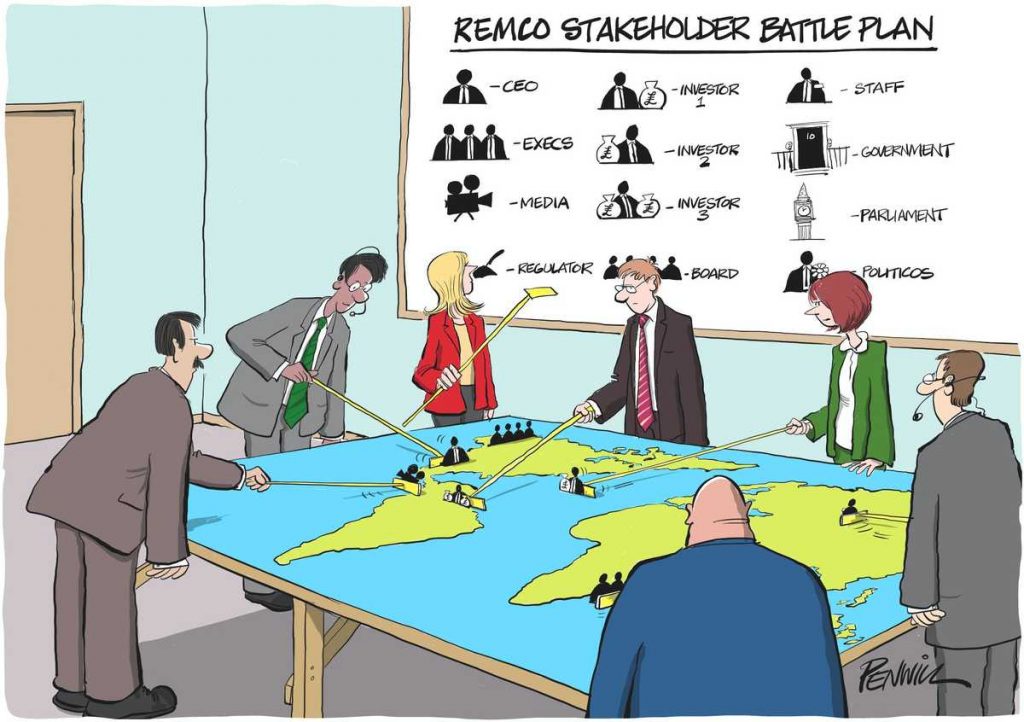

Remuneration Committees again on the front line

![]()

The RemCo needs to think through its strategic approach as getting it wrong can be costly

The Nominations Committee: not so easy after all

![]()

The NomCO role is complex and is not just about succession planning